11/05/ · The Quarters Theory is a trading strategy developed by Ilian Yotov. It is a market flow type of strategy which uses fixed distances in order to help traders identify possible reversal levels. It is also a versatile strategy since it allows for continuation trades as well as reversal blogger.comted Reading Time: 4 mins 12/11/ · Just a brief overview of how price quarter levels can help traders look for potential levels of support and resistance in the London forex trading session and other timeframes. For more information on price vibrations see Bill McLaren’s work blogger.com Are you struggling to be consistent with your trading? The Quarters Theory. An inside look at an innovative Forex trading system The Quarters Theory improves and simplifies the decision-making process in foreign exchange trading through the use of a revolutionary new methodology applied to the price behavior of currency exchange rates and trend developments in the Forex market

Identify Key Forex Chart Levels (And How to Trade Them) - My Trading Skills

Identifying key chart tools and knowing how to trade them plays an important role in your trading performance. Support and resistance levels form the basis of many technical price-levels and are essential tools in any technical toolbox. Key chart levels are important technical levels at which a financial instrument could face increased buying or selling pressure.

Traders look out for key chart levels to place their buy and sell orders around those lines, which accelerates price-moves and increases volatility when the price reaches those levels. Typically, key chart levels are identified by support and resistance lines, which act as barriers for the price when reached from the upside or downside, respectively. Support levels are price-lines at which the market had difficulties to break below, signalling that buyers may join the market again if the price falls to a key support level.

Resistance levels are quite similar to support levels, only that they form to the upside and signal price-levels at which the market had difficulties to break above. When the price reaches a key resistance level, sellers may jump into the market and send the price lower again. There are many types of key chart levels which act as important support and resistance levels in the chart. Horizontal key chart levels: As their name suggests, these are horizontal levels which are placed at the top of a previous swing high, or at the bottom of a previous swing low.

Horizontal key chart levels are then projected into the future to mark price-levels at which the market may retrace, as shown on the following chart, the quarter level on forex. Trendlines and channels are commonly used in Forex trading to spot uptrend and downtrends and ride the trend. The following chart shows how trendlines and channels could act as important turning points for the price. Just like with rising channels, the lower boundaries of a downward sloping channel act again as support levels, while the upper boundaries act as resistance levels for the price.

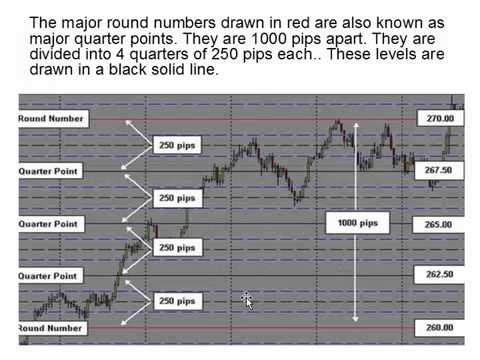

Channels are quite similar to trendlines, only that they include a second trendline which is drawn parallel to the first trendline. Round-Number Key Chart Levels: The quarter level on forex levels form around round-number exchange rates, such as 1. The psychology of market participants shows that traders tend to place their market orders around round numbers, increasing the buying or selling pressure around those levels.

Dynamic Key Chart Levels: Last but not least, dynamic key chart levels change with each new price-tick. Not all support and resistance levels work the same or produce trade setups with equal probability of success. Higher timeframes are more reliable when it comes to trading key chart levels, because a larger number of market participants pays attention to those levels, the quarter level on forex. Pullbacks refer to a retest of a broken support or resistance line before the price continues in the direction of the breakout.

Pullbacks work because support and resistance levels change their roles once broken. A broken support level becomes a resistance level, and a broken resistance level becomes a support level in future trading. This is shown on the following chart. The horizontal level marked with point 1 acted as a support for the price at point 2.

After the horizontal support was broken, the same line provided resistance for the price at points 3 and 4signalling potential short setups. They are used in finding uptrends and downtrends in the market by connecting higher lows in uptrends and lower highs in downtrends.

Again, try to focus on higher timeframes when using trendlines and channels in trend-following trading strategies, as market trends tend to be more predictable in the medium and long-term than on an intraday basis. Deutsche Bank published a great research paper on the Forex market and asked FX dealers to rate the predictability of market trends in the short, medium and long run. The table below shows the the quarter level on forex. Adapted from: Deutsche Bank Guide to Exchange Rate Determination As the table above shows, FX dealers believe that market trends are most predictable in the medium-term and long-term.

The majority of FX dealers Moving averages can act as a great support and resistance indicator. Moving averages are a technical indicator which takes the average price of the last n trading periods and plots it on the chart.

While simple moving averages the quarter level on forex an equal weight to all trading periods included in their calculation, exponential moving averages give more importance to the most recent price-data. The following chart shows how period, the quarter level on forex, period and period EMAs can work as dynamic support and resistance levels for the price. The day EMA is especially important and followed by a large number of traders. Many retail traders focus on day trading, especially in the beginning of their career.

Short timeframes such as the 5-minutes or minutes ones are often used by these traders to get the thrill that day trading provides. That said, trading on such short timeframes can often lead to costly mistakes and the accumulation of losses. As Elder Alexander puts it in his famous book, Come Into My Trading Room. If trading is a thrill, then day-trading provides the best rush. It is a joy to recognise a pattern on your screen, put in an order, and watch the market explode in a stiff rise, stuffing thousands of dollars into your pockets.

A former military pilot said that day-trading was more exciting than sex or flying jet aircraft. To increase the the quarter level on forex of profitable trades, first mark key support and resistance levels on higher timeframes, such as the 4-hour and daily ones. After this, zoom-in to the minutes charts to trade on shorter-term support and resistance levels. Whenever the price reaches towards the longer-term, but the minutes chart sends an opposing trading signal, your best bet would be to stay away from trading.

Step 1: Open the currency pair that you want to analyse Step 2: Select the 4-hour or daily timeframe to draw key support and resistance levels first.

Step 3: Identify obvious swing highs and lows and draw a horizontal line on them, the quarter level on forex. In the case of a price trending, use trendlines or channels to connect the highs or lows. Step 4: Zoom-in to shorter-term timeframes and repeat step 3 to find entry and exit points, or keep trading from the longer-term timeframes to get trade signals with higher probabilities of success. Many trend-following trading strategies rely on key chart levels to spot areas of major buying and selling pressure.

This is done by using trendlines and the quarter level on forex. Learning the ins and outs of trading key chart levels is best achieved by studying financial tradingexperience and screen time. Support and resistance levels are a powerful concept in technical analysis. Many technical tools have been developed to take advantage of support and resistance levels…. So, you want to become a day trader and join the hundreds of thousands of day traders who are living in the UK?

Then this…. Looking for a complete guide on how to trade double tops and bottoms in the Forex market? Then look no the quarter level on forex. Day trading is one of the most popular trading styles in the Forex market. However, becoming a successful day trader involves a lot of blood,…. Next: Step 2 of 4. Phillip Konchar December 11, The quarter level on forex by Step Guide to Forex Signals.

Did you know? An exchange rate of 1. Learn more, take our free course: Pivot Points: Fast Track, the quarter level on forex. How Do You Become a Professional Trader? Learn about Technical Analysis. Learn more, take our free course: How to Use Technical Indicators.

Longer-term timeframes, such as the daily or weekly, return higher-probability trade setups than shorter-term timeframe. What are Trailing Stops? What is Gapping? What Does Bet per Point Mean? Learn more, take our free course: Reversal Price Patterns. Categories: Skills. Phillip Konchar. Related Articles. Phillip Konchar December 6, Joe Bailey October 8, Phillip Konchar January 7, Phillip Konchar June 5, Phillip Konchar June 2, Request a Free Broker Consultation.

Phone including intl. If you are human, leave this field blank. Information you provide via this form will be shared with Forest Park FX only as per our Privacy Policy. MEMBERS ONLY The My Trading Skills Community is a social network, the quarter level on forex, charting package and information hub for traders.

Access to the Community is free for active students taking a paid for course or via a monthly subscription for those that are not. Buy community. Any person acting on this information does so entirely at their own risk. Any research is provided for general information purposes and does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Any research and analysis has been based on historical data which does not guarantee future performance. Shared and discussed trading strategies do not guarantee any return and My Trading Skills shall not be held responsible for any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained herein, the quarter level on forex.

Trading on leveraged products may carry a high level of risk to your capital as prices may move rapidly against you. Losses can exceed your deposits and you may be required to make further payments. These products may not be suitable for all clients therefore ensure you understand the risks and seek independent advice.

Historical data does not guarantee future performance.

High Probability QUARTER LEVELS For London Forex Trading

, time: 13:27The Quarters Theory blogger.com

23/12/ · The levels formed on an instrument in these periods are significant as they mark areas that key parties may deem as a “good price” to buy, or to take profits. Quarters are divided as follows: Q1 – January, February, March Q2 – April, May, June Q3 – July, August, September Q4 – October, November, December. The process for placing these levels is the same as yearly levels 14/05/ · Intraday Quarter Points- Psychological Levels. This template can be used for Higher Time Frame analysis in forex. Using the Bar Replay, develop a technical bias and mark psychological levels on the H4 timeframe. This can be used with Supply and demand and Quarter Points Theory 11/05/ · The Quarters Theory is a trading strategy developed by Ilian Yotov. It is a market flow type of strategy which uses fixed distances in order to help traders identify possible reversal levels. It is also a versatile strategy since it allows for continuation trades as well as reversal blogger.comted Reading Time: 4 mins

No comments:

Post a Comment