03/03/ · The two peaks on the sides are usually of the same height or close and the one in the middle is the highest. The Head & Shoulders pattern is considered one of the most powerful reversal patterns in the forex market. This pattern got the name because it actually reminds us of a head with two shoulders on the blogger.comted Reading Time: 8 mins In here, I’m going to show you 10 candlestick patterns here, which are commonly occurring on the forex charts everyday in all timeframes. These can be easily incorporated in most forex trading strategies as a buy or sell signal. Candlestick Patterns Are Classified Into Two Main Groups, Bearish Candlestick Patterns or Bullish Candlestick Patterns Forex reversal patterns are on chart candlestick formations of one or more candles or bigger chart patterns which forecast price reversals. Every chart pattern has a mass sentiment component that can help a trader in gauging potential price swings. There are two types of reversal chart patterns:Estimated Reading Time: 10 mins

Top 5 Forex Reversal Patterns To Enter Huge Trades - PriceActionNinja

Knowing when to enter the market is one of the most important skills in Forex trading. We should aim to hop into emerging trends as early as possible in order to catch the maximum price swing.

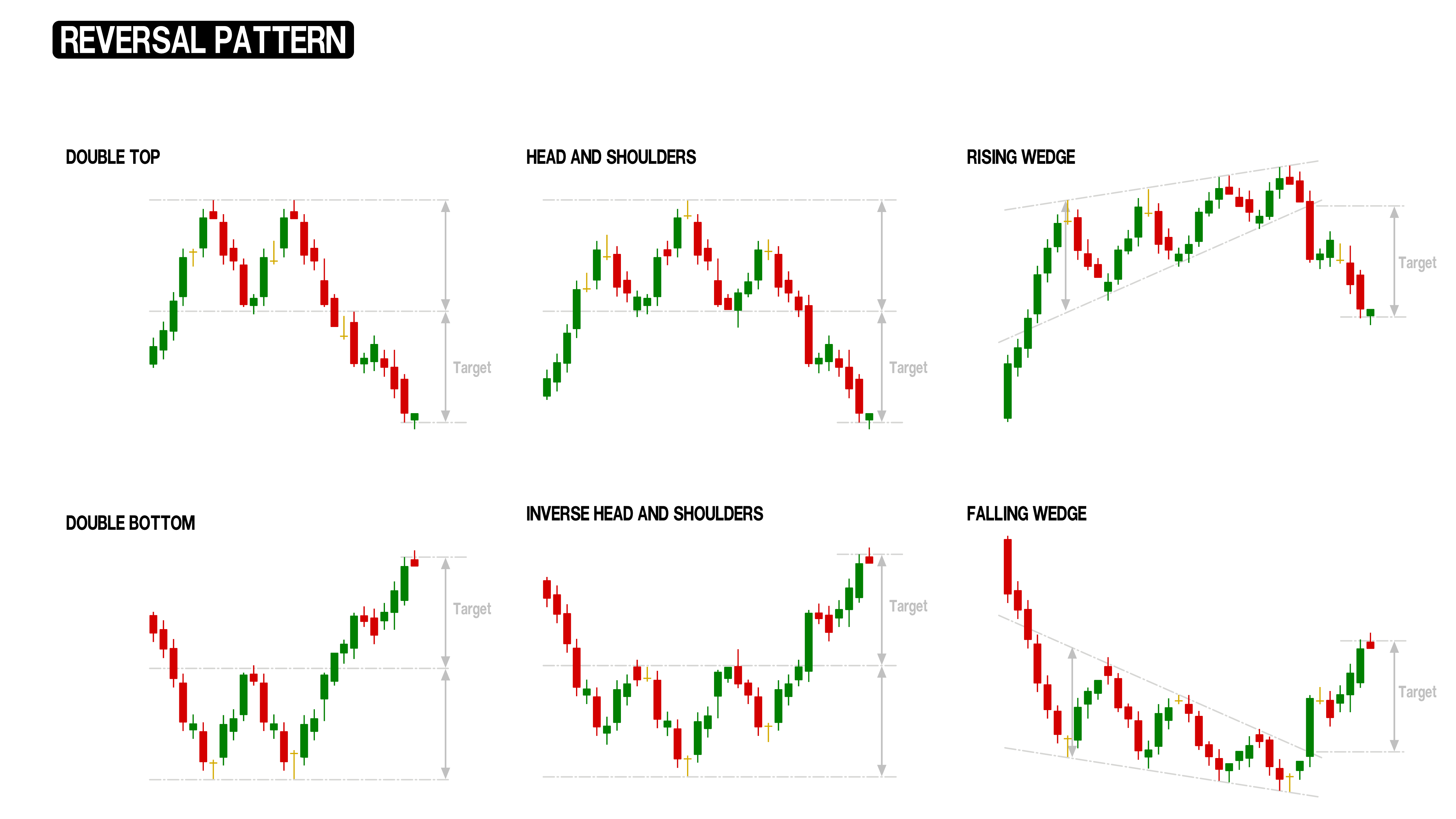

One of the best ways to do this is by predicting potential reversals on the chart. In this lesson, we will discuss some of the top Forex reversal patterns that every trader should know. Chart patterns can represent a specific attitude of the market participants towards a currency pair. For example, if major market players believe a level will hold and act to protect that level, we are likely to see a price reversal at that level.

Forex reversal patterns are on chart formations which help in forecasting high probability reversal zones, forex m pattern reversal. These could be in the form of a single candle, or a group of candles lined up in a specific shape, forex m pattern reversal, or they could be a large structural classical chart pattern.

Each of these chart formations has a specific reversal potential, which is used by experienced traders to gain an early edge by entering into the new emerging market direction, forex m pattern reversal. There are basic two types of trend reversal patterns; the bearish reversal pattern and the bullish reversal pattern.

The Bullish reversal pattern forecasts that the forex m pattern reversal bearish move will be reversed into a bullish direction. The bearish reversal pattern forecasts that the current bullish move will be reversed into a bearish direction. We will start with four of the most popular and effective candlestick reversal patterns that every trader should know.

First, the Doji is a single candle pattern. The Doji candle is created when the opening and the closing price during a period are the same. In this manner, the Doji candle has no body and it looks like a cross. The Doji can appear after a prolonged price move, or in some cases when the market is very quiet and there is no volatility.

In either case, the Doji candle will close wherever it has opened or very close to it. The Doji candlestick is typically associated with indecision or exhaustion in the market. When it forms after a prolonged trend move, it can also provide a strong reversal forex m pattern reversal. The candle represents the inability of the trend riders to keep pressuring the price in the same direction.

The forces between the bears and the bulls begin to equalize and eventually forex m pattern reversal direction. In the case above, you see the Doji candle acting as a bearish reversal signal.

Notice that the price action leading to the Doji candle is bullish but the upside pressure begins to stall as evidenced by the Doji candle and the two candles just prior to the Doji candle. After the appearance of the Doji, the trend reverses and the price action starts a bearish decent.

The Hammer candlestick pattern is another single candle which has a reversal function. This candle is known to have a very small body, a small or non-existent upper shadow, and a very long lower shadow. The Hammer pattern is only considered a valid reversal forex m pattern reversal if the candle has appeared during a bearish trend:.

This sketch shows you the condition you should have in order to confirm a Hammer reversal. In the first two cases, you have a bearish trend, which forex m pattern reversal to a bullish price move. The difference between the two candles is that in the second case the long wick it positioned in the opposite direction and this formation is called an Inverted Hammer.

In the second two cases we forex m pattern reversal a bullish trend which turns into a bearish trend. If the long shadow is at the lower end, you have a Hanging Man. If the long shadow is at the upper end, you have a Shooting Star. The chart above shows you a Shooting Star candle, which is part of the Hammer reversal family described earlier.

The shooting star candle comes after a bullish trend and the long shadow is located at the upper end. The shooting star pattern would signal the reversal of an existing bullish trend. The next pattern we will discuss is the Engulfing pattern. Note that this is a double candle pattern. This means that the formation contains two candlesticks, forex m pattern reversal. The engulfing formation consists of an initial candle, which gets fully engulfed by the next immediate candle.

This means that the body of the second candle should go above and below the body of the first candle. There are two types of Engulfing patterns — bullish and bearish. The bullish Engulfing appears at the end of a bearish trend and it signals that the trend might get reversed to the upside. The first candle of the bullish Engulfing should be bearish. The second candle, the engulfing candle, should be bullish and it should fully contain the body of the first candle. The characteristic of the bearish Engulfing pattern is exactly the opposite.

It is located at the end of a bullish trend and it starts with a bullish candle, whose body gets fully engulfed by the next immediate bigger bearish candle. Take a moment to check out this Engulfing reversal example below:. This chart shows you how the bullish Engulfing reversal pattern works. See that in our case the two shadows of the first candle are almost fully contained by the body of the second candle. This makes the pattern even stronger.

We see on this chart that the price reverses and shoots up after the Bullish Engulfing setup. To trade reversing candles, you should remember a few simple rules regarding trade entry, stop loss placement, and take profit. We will go this in the following section:. The confirmation of every reversal candle pattern we have discussed comes from the candle which appears next, after forex m pattern reversal formation.

It should be in the direction we forecast. After this candle is finished, you can enter a trade. In the Bullish Engulfing example above, forex m pattern reversal, the confirmation comes with the smaller bullish candle, which appears after the pattern.

You can enter a long trade at the moment this candle is finished, forex m pattern reversal. This would be the more conservative approach and provide the best confirmation. Aggressive traders may consider forex m pattern reversal a trade when the high of the prior bar is taken out in case of a bullish reversal pattern or when the low of the prior bar is taken out in case of a bearish reversal pattern. Never enter a candlestick reversal trade without a stop loss order.

You should place a stop order just beyond the recent swing level of the candle pattern you are trading. So, if you trade long, your stop should be below the lowest point of your pattern.

If you are going short, forex m pattern reversal, then the stop forex m pattern reversal be above the highest point of the pattern. Remember, this rule takes into consideration the shadows of the candles as well. The minimum price move you should aim for when trading a candle reversal formation is equal to the size of the actual pattern itself.

Take the low and the high of the pattern including the shadows and apply this distance starting from the end of the pattern. This would be the minimum target that you should forecast.

If after you reach that level, you may decide to stay in the trade for further profit and manage the trade using price action rules, forex m pattern reversal. We will start with the Double Top reversal chart pattern. The pattern consists of two tops on the price chart. These tops are either located on the same resistance level, or the second top is a bit lower. The Double Top has forex m pattern reversal opposite, called the Double Bottom.

This pattern consists of two bottoms, which are forex m pattern reversal located on the same support level, or the second bottom is a bit higher. These patterns are known to reverse the price action in many cases. Notice we have a double top formation and that the second top is a bit lower than the fist top.

This is a usual occurrence with a valid Double Top Pattern. The confirmation of the Double Top reversal pattern comes at the moment when the price breaks the low between the two tops. This level is marked with the blue line on the chart and it is called a trigger or a signal line. The stop loss order on a Double Top trade should be located right above the second top. The Double Top minimum target equals the distance between the neck and the central line, which connects the two tops.

The Double Bottom looks and works absolutely the same way, but everything is upside down. Thus, the Double Bottom reverses bearish trends and should be traded in a bullish direction.

The Head and Shoulders pattern is a very interesting and unique reversal figure. The shape of the pattern is aptly named because it actually resembles a head with two shoulders. The pattern forms during a bullish trend forex m pattern reversal creates a top — the first shoulder.

After a correction, the price action creates a higher top — the head. After another correction, the price creates a third top, which is lower than the head — the second shoulder. So we have two shoulders and a head in the middle. Of course, the Head and Shoulders reversal pattern has its upside down equivalent, which turns bearish trends into bullish.

This pattern is referred to as an Inverted Head and Shoulders pattern. Now let me show you what the Head and Shoulders formation looks like on an actual chart:. In the chart above we see price increasing just prior to the head and shoulders formation. This is an important characteristic of a valid head and shoulders pattern, forex m pattern reversal. The confirmation of the pattern comes when the price breaks the line, which goes through the two bottoms on either side of the head.

This line is called a Neck Line and it is marked in blue on our chart, forex m pattern reversal. When the price breaks the Neck Line, you get a reversal trading signal.

The Best Candlestick Patterns to Profit in Forex and binary - For Beginners

, time: 8:26Forex Patterns: What are they and how to read them

07/07/ · Both forex chart patterns signal a trend reversal. The rising wedge signals a bearish reversal, while the falling wedge signals a bullish reversal. The rising wedge is a price formation that can be identified by a series of higher lows followed by successive higher highs where the length of each subsequent price movement between the low and the high becomes smaller and blogger.com In here, I’m going to show you 10 candlestick patterns here, which are commonly occurring on the forex charts everyday in all timeframes. These can be easily incorporated in most forex trading strategies as a buy or sell signal. Candlestick Patterns Are Classified Into Two Main Groups, Bearish Candlestick Patterns or Bullish Candlestick Patterns Forex reversal patterns are on chart candlestick formations of one or more candles or bigger chart patterns which forecast price reversals. Every chart pattern has a mass sentiment component that can help a trader in gauging potential price swings. There are two types of reversal chart patterns:Estimated Reading Time: 10 mins

No comments:

Post a Comment