teknik analisa forex ~teori ~ ~ teori elliot wave ~ ~ fibonacci ratio ~ 1. Teori (Law of charts) Umumnya pergerakan harga akan membentuk suatu pola zigzag atau biasa disebut teori Dimana jarak lebih panjang dari dan harga akan meneruskan sesuai trend pada Estimated Reading Time: 6 mins Elliott Wave Patterns Studying the patterns is very important in order to apply the Elliott Wave Principle correctly. The pattern of the market action, if correctly determined, not only tells you to what price levels the market will rise or decline, but also in which way (or pattern) this will blogger.com Size: 1MB since is a certified Elliott Wave Analyst Level 1 with 93% score (). You can find more about my related learning & interested to learn a Forex trading system enough to make easy Just read pdf manual and apply indicators on charts. 2. Pull pips out of market by following buy/sell a rrows

Practical Elliott Wave Patterns Trading Strategies With Free PDF

The Elliott wave theory is based on the theory that the price of a certain asset tends to move with similar patterns. Ralph Nelson Elliott created the theory after elliot wave forex pdf that price tends to move in repetitive patterns and waves. He would then use these patterns to predict the future of where prices could move.

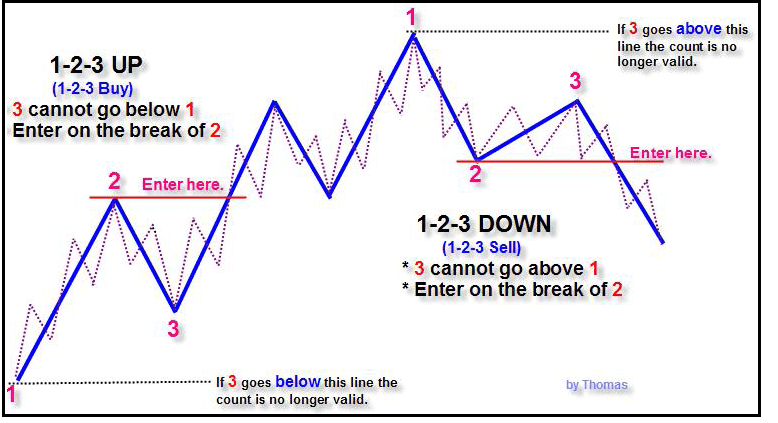

In this post, we go through exactly what Elliott wave trading is and how you can use it in your own trading. Free PDF Guide: Get Your Elliot Wave Strategies PDF Trading Guide. The Elliott wave principle believes that trending markets will normally move in five waves and then against the trend with three waves. The five movements with elliot wave forex pdf trend are referred to as motive waves, and the moves against the trend are called corrective waves.

You can use these waves on many different markets and time frames to find key areas in the market and find high probability trade entries, elliot wave forex pdf. The two main patterns that the Elliott wave follows are the elliot wave forex pdf phase and the corrective phase, elliot wave forex pdf.

The chart above shows that when the price makes this motive phase, it has three waves elliot wave forex pdf, with two short pullbacks lower. These short pullbacks are crucial for the trend to gain momentum, but the rules must be met for the motive phase to be accurate. The corrective phase moves into action with three moves.

Instead of being numbers, these moves are referred to as A, B and C moves, elliot wave forex pdf. The tricky thing about the corrective phase is that it can be tough to know if the market is going through a corrective phase until it has played out and the price has made its movements. Because the Elliott wave theory is that price moves in certain patterns, you can combine them with many other strategies and indicators.

The basic principle of the Elliott wave is that over any set time frame, the price will tend to trend in the same ways. You can use these movements and patterns to find high probability trades and look for a trend to make its next move.

As we go through below, you can look to make and manage your trades using these Elliott wave movements. Whilst you will often have to manually plot and mark your Elliott wave movements, you can also use an Elliott wave oscillator. The Elliott wave oscillator uses the difference between the faster moving 5-period moving average and the slower moving period moving average.

After applying the oscillator to your chart, elliot wave forex pdf, you can use it to find trends and market movements. When the price is trending higher, then the oscillator will show as green. This is because the faster moving 5 period moving average has been stronger than the slow-moving 35 period moving average.

When the price turns bearish, the oscillator will flip lower because the 5 moving average is moving lower compared to the 35 moving average. While you can use many different strategies to find and manage your trades with Elliott wave, the simplest is to follow the patterns.

The first step to this Elliott wave trading strategy is to wait until the price has formed the first three legs of the motive phase. After we notice these legs have successfully been formed in line with the rules, we are looking for a new trade with the trend. As price is making the fourth wave of the Elliott wave, we are looking for a new entry.

In the example below, we can see that we start to look for long trades as the price is making its fourth wave lower. You could also fine-tune your entry with other confirmation, such as bullish candlestick patterns. Because the Elliott wave will be invalidated if the price moves below the high of wave one, we could look to put our stop loss below this level. With this free MT4 indicator, you can quickly add all of the waves from the motive phase and the corrective phase.

Note that this indicator does not mark the Elliott waves for you. It is designed so you can quickly market the number and letters of each phase. You can get the free Elliott wave indicator for MT4 here, elliot wave forex pdf. Your Guide to Price Action Entries FREE PDF Download. How to find, elliot wave forex pdf, enter and place stop losses on the best price action entries. I hunt pips each day in the charts with price action technical analysis and indicators.

My goal is to get as many pips as possible and help you understand how to use elliot wave forex pdf and price action together successfully in your own trading. Skip to content. NOTE: You can get your free Elliott wave patterns strategies PDF guide below.

Table of Contents. NOTE: If you do not yet have the best MT4 charts to use these pip counter indicators, you can read about how to get the best free trading charts and the broker to use these indicators with here. Featured Brokers Overall Rating Trade Now. Pip Hunter I hunt pips each day in the charts with price action technical analysis and indicators.

Elliott Wave for Beginners - ULTIMATE In-Depth Guide!

, time: 36:59

Motive waves. Elliott Wave Basics — Impulse Patterns The impulse pattern consists of five waves. The five waves can be in either direction, up or down.. The first wave is usually a weak rally with only a small percentage of the traders participating. Once Wave 1 is over, they sell the market on Wave 2. The sell-off in Wave 2 is very vicious In The Elliott Wave Principle — A Critical Appraisal, Hamilton Bolton made this opening statement: As we have advanced through some of the most unpredictable economic climate imaginable, covering depression, major war, and postwar reconstruction and boom, I have noted how well Elliott's Wave Principle has fitted File Size: 2MB Free Elliott Wave PDF The free Elliott Wave PDF by Kenny at Traders Day Trading is our quick start guide that will give you a very good overview of the basics of the Wave theory. The PDF gathers together much of the information on EW that is published on this site into a handy PDF reference guide which is free to download

No comments:

Post a Comment