12/05/ · The answer comes from traders now knowing when to use these overbought and oversold levels. Provided that a range market or a ranging environment is expected, the only way to find these areas is by using oscillators. Any oscillator from the ones listed above can show overbought and oversold levels 23/09/ · SELL: If the price is overbought area AND it is an hourly close area, the Overbought Oversold indicator shows the SELL arrow. Suggestion: You can make a combination of every oscillator indicator (RSI, MACD, Stochastic, etc.) and some indicator that can filter the number of blogger.comted Reading Time: 9 mins 16/05/ · With EURUSD for example, when the market became overbought, % of times it moved down again in the same period afterwards. In % of cases EURUSD moved higher again immediately after becoming oversold. What this test proves is that most currencies do show evidence of pushing back the other way after reaching overbought or oversold levels. The strength of that push is often proportional to the amount the market is oversold or overbought Estimated Reading Time: 7 mins

How to Spot an Overbought or Oversold Market - Forex Opportunities

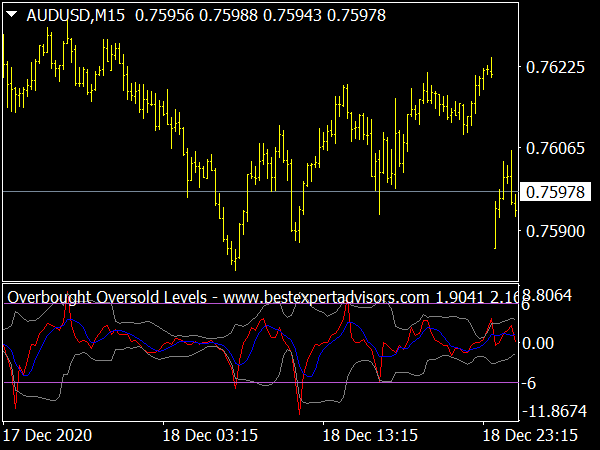

You can now download the Overbought and Oversold Forex Indicator for free on AtoZ Markets indicators gallery. With the indicator, you can see when the market could be potentially exhausted, and this will highly improve your trading results. Overbought and Oversold Forex Indicator works well on 15M, 30M, 1H, and 4H time frames and any currency pair, check overbought oversold forex.

The interpretation of the indicator is simple. The indicator shows the period when the market move could be exhausted, or is nearing its end. You can trade more accurately, execute check overbought oversold forex trades, and make higher profits. Overbought means a period where there has been a significant and consistent upward move in price without much pullback. Check overbought oversold forex the other hand, oversold describes a period where there has been a significant and consistent downward move in price without much pullback.

Currency pairs that are overbought or oversold have a greater chance of reversing direction but could remain overbought or oversold for a long period. Note: This indicator was developed by fxtradingrevolution. AtoZ Markets does not carry any copyrights over this trading tool. Publish on AtoZ Markets.

Get Free Trading Signals Your capital is at risk. Download Indicator. close ×.

The Only Overbought Oversold Indicator That Works

, time: 7:57How to Identify or Dismiss an Oversold / Overbought

28/02/ · You often hear traders saying that a currency pair is overbought or oversold – the pair moved strongly in one direction, that it necessarily needs to pull back and correct, at least part of the move. This could be the case, but it could be just a blogger.comted Reading Time: 2 mins There are two popular indicators which help traders identify overbought and oversold conditions: Relative Strength Index (RSI) Stochastic Oscillator; RSI is a range bound oscillator which is scaled from 0 to When RSI reads above 70, it indicates the overbought situation. If it reads below 30, it indicates the oversold Estimated Reading Time: 4 mins 17/02/ · RSI is specificly used to identify overbought and oversold conditions in the market. It is scaled from 0 to , and typically, readings below 30 indicate oversold, while readings over 70 indicate overbought

No comments:

Post a Comment