11/02/ · I am also trading in a mini account with $ At the moment I am using to trade like you. Max risk is 1% per trade. So the dollar amnt is $10 per trade. If you trade with lots, then the max stop loss is 50pips. If you trade in 1Hr - 15 Min charts 50 pips SL is a good move 16/03/ · The Forex market, although unregulated by an exchange, does have strict rules in place for the brokers. You will want to ensure you find a Forex broker where you can trade at least 1 micro-lot. Micro Lot = units of the base currency in a Forex pair. Trading a micro lot with $ in your account will allow you to use just enough risk so you don’t blow out your trading account with a string of losers and you may build FXCM UK has placed the maximum leverage for all forex pairs to and to be able to place 1 lot, you need to have at least $ to $10, in your account to safely trade 1lot. Continue Reading. I don’t think that you have a choice with a $ account on a leverage

Is $ Enough to Start Trading?

Last Updated: June 29, By Rayner Teo. Trading refers to the buying and selling of financial securities, in an attempt to earn a profit over time. Day trading — traders who seek to capture intraday can i trade 1 lot with a 1000 forex account, typically closing their trades within a day. Swing trading — traders who seek to capture swings in the market, can i trade 1 lot with a 1000 forex account, typically holding their trades for few days to weeks.

Position trading can i trade 1 lot with a 1000 forex account traders who seek to capture trends in the market, typically holding trades for weeks to months. In order to be profitable, you need to an edge in the markets and allows the law of large number to work in your favor.

An edge is when you have a set of trading rules that yields a positive expectancy over time. If you have a positive expectancy after trades, then you possibly have an edge in the markets.

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value and will tend to become closer as more trials are performed.

In other words, your trading results are random in the short run but will be closer to your expected value in the long run. This means you will encounter losing streaks. And the last thing you want is to empty your trading account during a losing streak.

Practise strict risk management. The transaction cost itself is more than your risk per trade. Your trade requires a stop loss of 50 pips. But they conveniently forget to tell you the number of trading accounts they blow up along the way.

So if you go with a broker which offers nano-lots, it might be possible to be trading off the Daily timeframe. If you want to be a consistently profitable traderyou must understand what is your edge, and how the law of large number works. You will encounter losing streaks, and only proper risk management will prevent the risk of ruin. You can download it here for FREE. Standard Chartered has no commission fee, just small charges. You can only buy stocks and the currency spread is wide if you need to convert currencies to buy foreign stocks.

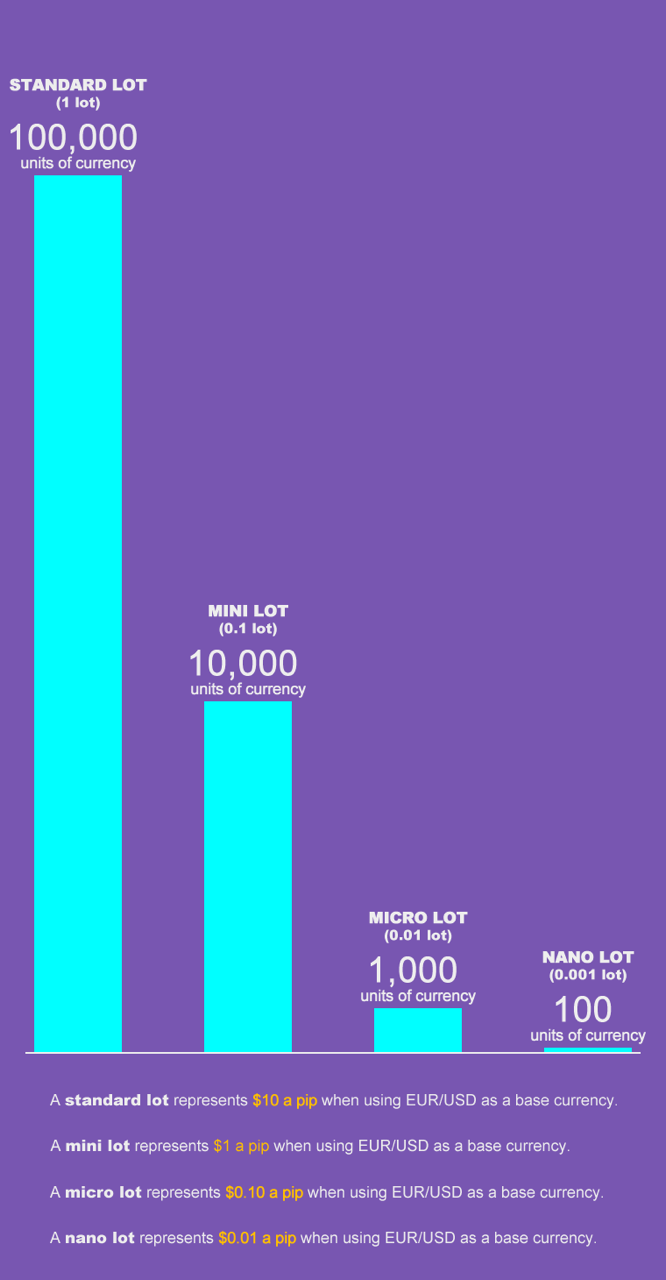

User interface is not as good as a brokerage too. Are you talking about standard chartered bank? If yes then please let me know website and some details. Because you can one trade micro lot which is 10 cents a pip. Some broker even offer nano lots where you can trade even a smaller pip value than that. You can look at this position sizing calculator here. Nice discussion and it is helpful! I mostly trade Forex and have minimal exposure to Sugar, Oil, and Gold according to past reviews by you.

I am gearing up to increase my exposure to other Markets in order to increase the possibility of finding a trend as you have suggested in the the past.

And if not, what would be the minimum amount I should have in my account to be able to trade all the Markets you trade? First of all i want to compliment and thank can i trade 1 lot with a 1000 forex account for sharing your experience and knowledge on trading.

I am a newbie on trading, got interested in it this summer and every day i am trying to learn on this matter. There is much info available on the internet but as you say also what is the quality of much what i read. Trend following looks promising but i was wondering if it is possible to use on a small account when you have to diversify and hold several positions for a longer time. Also i have a question on SR lines. One of the rules is no expectations.

What is the purpose of these lines then? If you want to adopt a trend following approach with a small account, then it would be prudent to trade forex and CFDs. First of all a happy new year to you and everyone and good trading! Sorry i used the wrong words i think. I know that counts for MA lines too, but SR lines i have to draw myself and are more dependent on skill etc. Vice versa for downtrend. Most forex brokers would offer micro lots.

Please log in again, can i trade 1 lot with a 1000 forex account. The login page will open in a new tab. After logging in you can close it and return to this page. The answer is, yes and no. The various types of trading are: Day trading — traders who seek to capture intraday volatility, typically closing their trades within a day. The elusive edge traders are talking about An edge is when you have a set of trading rules that yields a positive expectancy over time. But wait… Having an edge alone is not enough.

You also need to allow the law of large number to work in your favor. What is that exactly? The law of large number and why it matters The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times, can i trade 1 lot with a 1000 forex account.

This means: Even if you have an edge in the markets, you can expect to lose over the next 10 trades. But after trades or more you can expect to be close to your positive expectancy. Do this: Toss your coin 10 times and check how many percent of the time it comes up head or tail. Now toss your coin times and check how many percent of the time it comes up head or tail.

So how do you prevent the risk of ruin? Which financial instruments can you trade? Clearly trading stocks is not feasible. Clearly, trading futures is not feasible either. Your transaction cost is now a fraction of your risk per trade.

If you want to know which instruments you can trade safely, just do this: 1. Calculate how much you will lose if you get stopped out of your trade 2. This is the truth… The reality of trading is this… You need money to make money. Else, you can go into the 4-Hour timeframe. It depends on the broker and the margin required to trade the CFDs of those markets. Share 0. Tweet can i trade 1 lot with a 1000 forex account. I have back account there but in different country.

Hello Hidayat, Thanks for sharing. I believe that will be useful for stock traders in Singapore. Hope to hear more from you in the near future �� Rayner, can i trade 1 lot with a 1000 forex account. Hi Rayner! Thanks for sharing! Hi numberator, Time frame does not make much of an impact in forex. Hey Chaplainrick, This would vary from broker who offers CFDs. is that enough to start trading forex using daily charts?

Regards, Cornelis. Hello Cornelis, If you want to adopt a trend following approach with a small account, then it would be prudent to trade forex and CFDs. Hi Rayner, First of all a happy new year to you and everyone and good trading! Hello Cornelis, Happy new year!

Okay I get what you mean. Hello Glen, Most forex brokers would offer micro lots. Close dialog. Session expired Please log in again.

Lot Sizes EXPLAINED! (Forex Trading)

, time: 7:43

11/02/ · I am also trading in a mini account with $ At the moment I am using to trade like you. Max risk is 1% per trade. So the dollar amnt is $10 per trade. If you trade with lots, then the max stop loss is 50pips. If you trade in 1Hr - 15 Min charts 50 pips SL is a good move FXCM UK has placed the maximum leverage for all forex pairs to and to be able to place 1 lot, you need to have at least $ to $10, in your account to safely trade 1lot. Continue Reading. I don’t think that you have a choice with a $ account on a leverage 29/06/ · Trading Forex is feasible with a $ account. If you want to know which instruments you can trade safely, just do this: 1. Calculate how much you will lose if you get stopped out of your trade. 2. Calculate your transaction cost. Add 1 & 2 together, if it’s below 1% of your trading account, the instrument is feasible to trade. Now you may wonder:Estimated Reading Time: 7 mins

No comments:

Post a Comment